SCG Tokenomics

Designed for Sustainable Web3 Gaming

Key Highlights

SCG is the core asset of the ecosystem, enabling value exchange, community participation, and economic flow. It powers match rewards, NFT upgrades, league operations, and various user incentives.

-

Total Supply:

10,000,000,000 SCG

-

Use Cases:

NFT evolution and combination, match entry fees, league NFT access, user rewards, and revenue sharing

-

Supply Policy:

Managed through structured lock-ups, vesting, auto-burn mechanisms, and progressive halving schedules

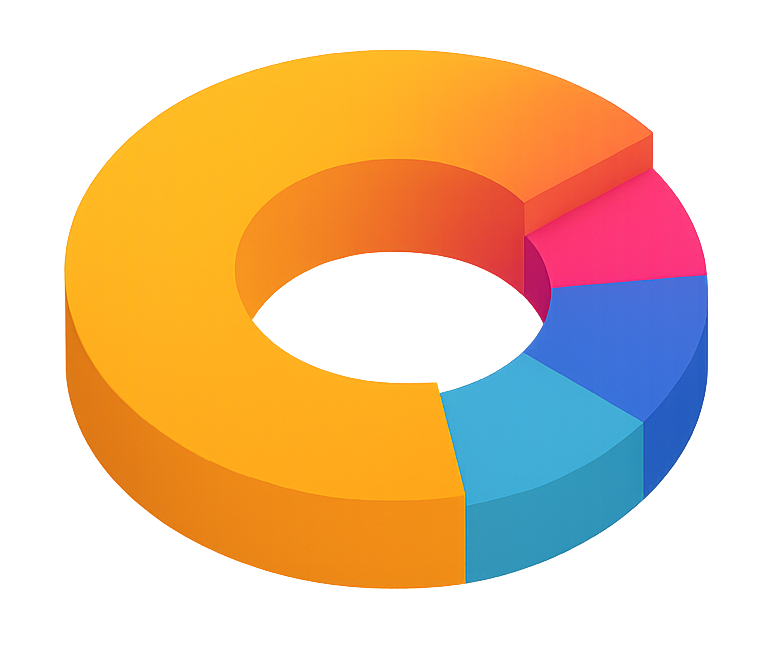

Token Allocation

SCG tokens are strategically allocated to support ecosystem operations, user rewards, and project growth. The structure is designed to promote long-term engagement and ensure healthy liquidity.

Ecosystem Build Table73%

5%Token Sale Table

10%Future Strategic Allocation

12%Liquidity Provision Table

Ecosystem Build Table

- Category Ratio Quantity Description

- Community Activity Reserve 30% 3,000,000,000 48-month linear vesting

- Foundation & Marketing 10% 1,000,000,000 48-month linear vesting (20,833,333/month)

- Strategic Partnerships 12% 1,200,000,000 TGE 5%, 12-month cliff, then 36-month linear vesting

- Team 8% 800,000,000 24-month cliff, then 24-month linear vesting

- Ecosystem Development Fund 13% 1,300,000,000 TGE 10%, 12-month cliff, then 24-month linear vesting

Future Strategic Allocation

- Category Ratio Quantity Description

- Future Strategic Allocation 10% 1,000,000,000 Full lockup, unlocked and used after approval from the team and community

Token Sale Table

- Category Ratio Quantity Description

- Token Sale (VC) 2% 200,000,000 TGE 20% (40,000,000), then 24-month linear vesting

-

Token Sale (P/S)

2%

200,000,000

TGE40%(80,000,000), 3-month cliff,

then 24-month linear vesting - IDO(Boosting Round) 1% 100,000,000 TGE 100%(100,000,000)

Liquidity Provision Table

- Category Ratio Quantity Description

- Liquidity Provision 7% 700,000,000 TGE 30%, Year1 35%, Year2 35%

- Strategic Reserve 5% 500,000,000 48-month linear vesting